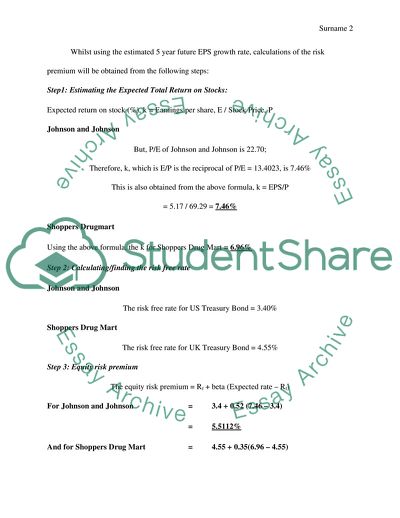

The DDM and PEG Methods of Equity Valuation, the Risk Premium, the Bes Assignment. https://studentshare.org/finance-accounting/1789241-equity-valuation

The DDM and PEG Methods of Equity Valuation, the Risk Premium, the Bes Assignment. https://studentshare.org/finance-accounting/1789241-equity-valuation.