StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Put-Call Parity for Currency Options

Free

Put-Call Parity for Currency Options - Statistics Project Example

Summary

That is, the above hypothesis asserts that if β was 1, then the market will be perfect and so the possibilities to achieve arbitrage profits will be nil. Otherwise, if β was not equal to 1, then certain opportunities that will enable investors to find spots to gain arbitrage…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER94.4% of users find it useful

- Subject: Finance & Accounting

- Type: Statistics Project

- Level: Business School

- Pages: 4 (1000 words)

- Downloads: 0

- Author: hodkiewiczthere

Extract of sample "Put-Call Parity for Currency Options"

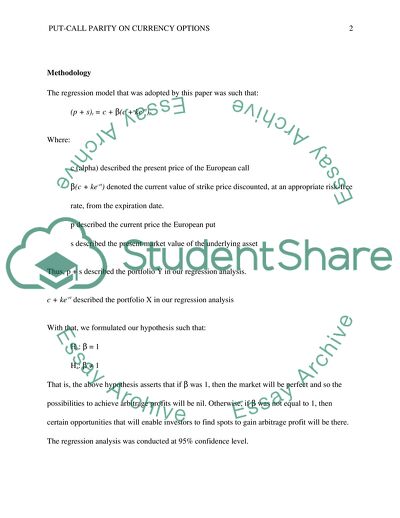

Put-call parity for currency options s affiliation Methodology The regression model that was adopted by this paper was such that:

(p + s)t = c + β(c + ke-rt)t

Where:

c (alpha) described the present price of the European call

β(c + ke-rt) denoted the current value of strike price discounted, at an appropriate risk-free rate, from the expiration date.

p described the current price the European put

s described the present market value of the underlying asset

Thus, p + s described the portfolio Y in our regression analysis.

c + ke-rt described the portfolio X in our regression analysis

With that, we formulated our hypothesis such that:

Ho: β = 1

Ha: β ≠ 1

That is, the above hypothesis asserts that if β was 1, then the market will be perfect and so the possibilities to achieve arbitrage profits will be nil. Otherwise, if β was not equal to 1, then certain opportunities that will enable investors to find spots to gain arbitrage profit will be there. The regression analysis was conducted at 95% confidence level.

Results

The regression results for the model was summarized in Table 1 below.

Table 1. Summary statistics

Variables

Beta

alpha

0.04557

6632.93

Standard deviation

0.03173

290.85

p-value

0.151

0.000

t-value

1.44

22.80

The confidence interval, according to Poitras (2010), for the regression is β ± t *standard deviation of beta. We had over 500 observations in our data, and so we use 1.96 as a replacement of t stated in the t-table. As such, the conclusions from the regression model was that our null hypothesis (β = 1) could not be rejected. The null hypothesis (Ho) could not be rejected since the projected parameter interval was 0.04557 ± 1.96*0.03173 plus 1 at 5% significance level. Moreover, the standard deviation was as small as 0.03173. The low variance indicated that some observations appeared to be around the mean. Our p-value for the regression was acceptable because it was below 0.05. Thus, our model was highly significant, and there was only 5% risk of rejecting our null hypothesis when it is true.

Discussion

In general, if we were to draw a graph of portfolio Y against portfolio X, any point within the line will imply that our Put-call parity holds. However, points that deviate from the line suggest that there can be some arbitrage opportunities. The more any point deviate from this straight line, the higher the probability of make the arbitrage profit from it. If the point deviates on the left side of the line, the implication is that portfolio X is underestimated as opposed to portfolio Y. Similarly, if the point deviates on the right side of the line, the implication is that portfolio Y is underestimated as opposed to portfolio X. From such graphs, most options below appear to be correctly priced which signposts that Put-call parity is in play (it holds), and no additional arbitrage profit is possible to make.

Our result meant that it was impossible for a stockholder to make new extra arbitrage profits. Each profitable arbitrage opportunity had already been exhausted. We could say that the market was efficient since all profitable transactions had been undertaken. DeRosa (2011) claims that as the interest rate goes up in the economy anticipated returns tend to go up while the present value of forthcoming cash flow of the option bearers decreases. The combined impact is to lessen the value of our put option but increase the call option`s value. The significance of an efficient marketplace for financial mechanisms is crucial. A completely efficient market exist when all the information is replicated in the market prices, and it`s completely impossible to generate abnormal profits even with the insider information.

When the market is completely inefficient, arbitrage opportunities will arise. Niclas & Mattias (2010) recognized the three kinds of market efficiency exist; weak, strong and semi-strong. Weak form efficiency occurs when no past data can be utilized to gain abnormal profits. It is difficult to outdo the market with any info on past data. Certain forms of elemental analysis can give investors an advantage though technical analysis will be useless at times. Semi- strong market efficiency occurs when both fundamental and technical analysis is useless. As such, the price of any stock will, just after the financial information become public knowledge, reach its “correct” price. Finally, a strong form of market efficiency occurs when all private and public information is reflected in stock price. According to Glabadanidis & Palgrave Connect (2014), it is difficult to gain abnormal profits, even if investors have insider information.

There are numerous kinds of definitions that explain arbitrage. According to DeRosa (2011), arbitrage can be defined as the concurrent buying and selling of a fundamentally similar security within two dissimilar markets for profitably different prices. However, Madura (2008) defines arbitrage as the situation where a dealer finds two individuals who are willing to trade, and so the dealer goes ahead and make the trade. For the effort the dealer makes, he or she will be compensated with at least some money, which is the arbitrage profit. Therefore, the cheaper the dealer can buy any good in one market and sell it, in another market, at a higher price the more arbitrage profit the dealer will gain.

With such explanations of arbitrage in mind, this paper will consider arbitrage as a situation when one buys either a put or a call and consolidate it with the stock of the underlying asset. As such, if put-call parity is irrelevant (does not hold), we will just purchase the undervalued portfolio but short sell the overrated portfolio. We also need to purchase the underlying asset.

There are certain risks investors must consider when employing arbitrage strategies in trading. First they must have a good deal of knowledge concerning how to go about the necessary trades in order not to end up with options of dissimilar maturities or with semi-complete arbitrage. In theory, arbitrage needs no capital, and it is also absolute risk-free. However, in reality this is never true. Madura (2008) argues that arbitrage need much capital and is nonetheless risky sometimes. Furthermore, Apte (2010) claims that the capital-free arbitrage is just an illusion. Most arbitrages performed on the equity and bond market is nonetheless risk arbitrages. Such arbitrages need capital and are thus we cannot be very sure they are profitable.

Conclusion

This paper has examined whether we can make arbitrage profits using a given index option. We have used the formula for Put-call parity and performed the necessary regression analysis so as to test our null hypothesis. From the results, we found that it is nearly impossible for any investor to make fresh and extra arbitrage profits at the given index option. Bigger institutions might find arbitrage opportunities though it is never obvious that they will make any profit from it. Therefore, our conclusion was that the option was a highly efficient market.

References

Apte, P. G. (2010). International financial management. New Delhi u.a: Tata McGraw Hill.

DeRosa, D. F. (2011). Options on foreign exchange. Hoboken, N.J: J. Wiley.

Glabadanidis, P., & Palgrave Connect (Online service). (2014). Absence of arbitrage valuation:

A unified framework for pricing assets and securities.

Madura, J. (2008). Financial markets and institutions. Mason Ohio: Thomson.

Niclas B, & Mattias, O. (2010). Arbitrage using put-call parity: An empirical studies of

OMXS30 index options.

Poitras, G. (2010). Valuation of equity securities: History, theory and application. Singapore:

World Scientific.

Read

More

CHECK THESE SAMPLES OF Put-Call Parity for Currency Options

Forward Contract, Futures Contract, Currency Options

The paper "Forward Contract, Futures Contract, currency options" states that contracts are non-transferable.... The standard volume refers to non-tailored transaction amounts being able to be traded on markets, currency options; which is regularly used as hedging instrument given that it guarantees a worst-case exchange rate for a given future currency purchase for another and are also contracts although they cost more as compared to forward contracts, and currency swaps which are also very popular and applicable to long term period with raised volume under an ensured high liquidity....

3 Pages

(750 words)

Essay

Risk financing and portfolio management

While there is some bad news that equities represent a risky asset class, the good news is that the risk can be reduced or eliminated completely with the use of derivatives, such as various options, futures, forwards and swaps (Bodie et al.... The objective of this report is to show how options (calls and puts) and option spreads can be used to hedge against the risk of an equity investment.... options Strategies as of the 1st of December 2011 This section describes how long and short positions in the stock can be hedged using puts, calls and spread options....

10 Pages

(2500 words)

Essay

Hedging Strategies: Forwards, Futures & Options

The paper "Hedging Strategies: Forwards, Futures & options" states that Virtual Books are going to engage in the import of certain products from Slovakia which will trigger a cash outflow in Euros.... The three top runners for hedging purposes in exchange rates are Forward Contracts, Futures Contracts and options.... he last alternative is that of options.... options are both exchange-traded and OTC.... Furthermore, options have a lot of versatility like European options or American options....

3 Pages

(750 words)

Essay

Discuss the Role of Exchange Traded Currency Options in Risk Management

Topic: Discuss the role of exchange traded currency options in risk management Institution Affiliation: Date: Contents Trading currency options 7 Currency volatilities and the underlying risks 8 Interest rate consideration 9 Hedging with Options-Risk Management Factor 10 Conclusion 11 References 12 Introduction Exchange traded currency options make use of contracts that are standardized, given the specific currency underlying in such exchange transaction....

9 Pages

(2250 words)

Essay

Role of Currency Options in International Trade

The essay "Role of currency options in International Trade" focuses on the analysis of the issues in the role of currency options in international trade.... oreign exchange traded currency options give a company or an individual the right to exchange the currency of their country into another currency of another country at a pre-agreed exchange rate at a given time in the future.... With a few exceptions that are traded on exchanges such as the International Securities Exchange, the Philadelphia Stock Exchange, or the Chicago Mercantile Exchange that have options for future contracts (Dong-Hyun & Gao, 2003)....

11 Pages

(2750 words)

Essay

Currency Derivatives: Instruments Fixed and Open Outcomes

options have an asymmetric return profile: an option is an option with one party.... Hence, options have an asymmetric return profile.... options are best for serious investors, who have less time to invest in research and to execute the trade.... options are the best options for intermediate or long-term investment as they do not alter with daily fluctuations1.... This essay "currency Derivatives: Instruments Fixed and Open Outcomes" explores the currency derivative that is mean a financial instrument which is a contract, characterized by different types of products like, forward, future, option, and also swap....

5 Pages

(1250 words)

Essay

International Parity Conditions and Market Instruments

The chapter deals with specific instrumental policies by virtue of which the risks associated with high volatility in foreign currency value can be lowered in the market.... Such policies help an importing nation (with liability to pay back foreign currency) avoid risks associated.... The paper deals with specific instrumental policies by virtue of which the risks associated with high volatility in foreign currency value can be lowered in the market....

6 Pages

(1500 words)

Assignment

Currency Options - Put-Call Parity

2The carrying cost is presented as b = r – qThe alpha and beta are therefore calculated as:α = 2r / σ^2β = 2b / σ^2At least one option-pricing model for the put and the call prices is expected to satisfy the put-call parity for it to be accepted otherwise, it has to be rejected (Lung and Nishikawa, 2005).... The paper 'currency options - Put-Call Parity' is a meaningful example of a finance & accounting research paper.... 1 The paper 'currency options - Put-Call Parity' is a meaningful example of a finance & accounting research paper....

7 Pages

(1750 words)

Research Paper

sponsored ads

Save Your Time for More Important Things

Let us write or edit the statistics project on your topic

"Put-Call Parity for Currency Options"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY