Additional Capital Sources for Target Corporation Assignment. https://studentshare.org/finance-accounting/1742047-busimess-accounting

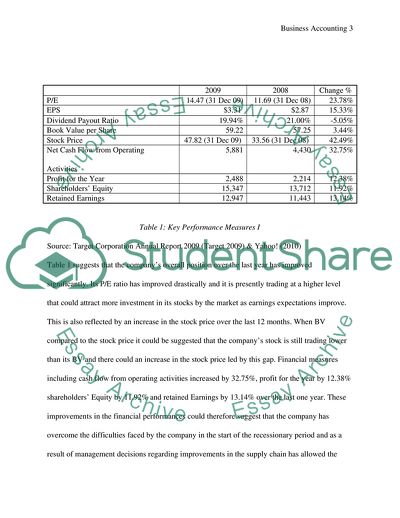

Additional Capital Sources for Target Corporation Assignment. https://studentshare.org/finance-accounting/1742047-busimess-accounting.