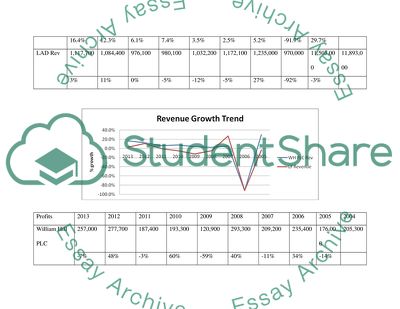

Compare the historical performance of William Hill against Ladbrokes Essay. https://studentshare.org/finance-accounting/1843366-compare-the-historical-performance-of-william-hill-against-ladbrokes-for-their-growth-analysis-over-the-last-few-years

Compare the Historical Performance of William Hill Against Ladbrokes Essay. https://studentshare.org/finance-accounting/1843366-compare-the-historical-performance-of-william-hill-against-ladbrokes-for-their-growth-analysis-over-the-last-few-years.