Evaluation of the two companies from the perspective of a potential Essay. https://studentshare.org/finance-accounting/1867753-evaluation-of-the-two-companies-from-the-perspective-of-a-potential-equity-investor

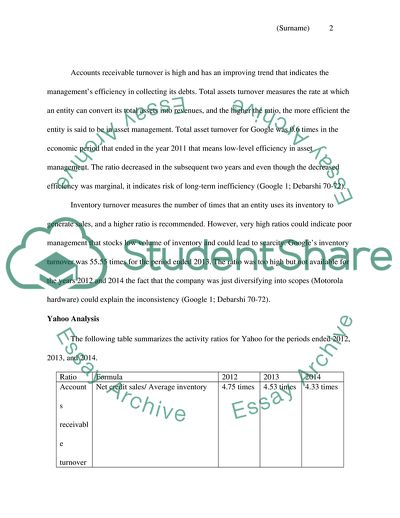

Evaluation of the Two Companies from the Perspective of a Potential Essay. https://studentshare.org/finance-accounting/1867753-evaluation-of-the-two-companies-from-the-perspective-of-a-potential-equity-investor.