StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Strategic Management Accounting: The Brokenhill Auto Ltd

Free

Strategic Management Accounting: The Brokenhill Auto Ltd - Case Study Example

Summary

"Strategic Management Accounting: The Brokenhill Auto Ltd" paper states that Mr. Brokenhill could improve the communication concerning the company’s goal and how the performance of each department can contribute to the company’s overall economic performance rather than competing among each other…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER98.9% of users find it useful

- Subject: Finance & Accounting

- Type: Case Study

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

- Author: isobelherman

Extract of sample "Strategic Management Accounting: The Brokenhill Auto Ltd"

Strategic Management Accounting The Brokenhill Auto Ltd. Executive Summary William Brokenhill, the owner and manager of the Brokenhill automobiledealership, ding that the company has problem with rapid growth. Though he considers that the principal business has been paid off, he wants to increase sales by establishing three new divisions: a new car sales department, a used car sales department, and the service department. The recent trade-in incident creates a dilemma because each department is beginning to compete among each other and overlook the goal of the company as a whole. Despite of the argument about which department brings in profit, overall, the company still gain in the trade-in.

1 Every department wants to be profitable. It requires the establishment of strategic planning with a formal control system, which includes the rules, physical controls, the manuals, system safeguards, task control system, and formal control process.

2 As business units are created as profit centers, it requires profitability measurements to evaluate each profit center. This includes management performance and economic performance. The types of profitability measurements can be obtained from the analysis of the company’s overall contribution margin, direct profit, controllable profit, income before income taxes, and net income.

3 Therefore, Mr. Brokenhill could have improve the communication concerning the company’s goal and objectives and how the performance of each department can contribute to the company’s overall economic performance rather than competing among each other. All departments should increase performance and that their goals should also congruence to the goals of the company.

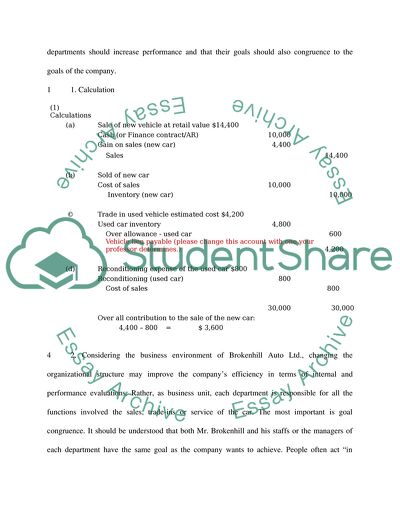

1 1. Calculation

(1) Calculations

(a)

Sale of new vehicle at retail value $14,400

Cash (or Finance contract/AR)

10,000

Gain on sales (new car)

4,400

Sales

14,400

(b)

Sold of new car

Cost of sales

10,000

Inventory (new car)

10,000

©

Trade in used vehicle estimated cost $4,200

Used car inventory

4,800

Over allowance - used car

600

Vehicle lien payable (please change this account with one your professor determines.)

4,200

(d)

Reconditioning expense of the used car $800

Reconditioning (used car)

800

Cost of sales

800

30,000

30,000

Over all contribution to the sale of the new car:

4,400 – 800 =

$ 3,600

4 2. Considering the business environment of Brokenhill Auto Ltd., changing the organizational structure may improve the company’s efficiency in terms of internal and performance evaluations. Rather, as business unit, each department is responsible for all the functions involved the sales, trade-ins or service of the car. The most important is goal congruence. It should be understood that both Mr. Brokenhill and his staffs or the managers of each department have the same goal as the company wants to achieve. People often act “in accordance with their perceived self-interest are also in the best interest of the organization” (Anthony & Govindarajan, 2000, 59).

5 Internal and external factors affect goal congruence. For example, the internal factors may involve work ethic, management style, and the culture of the company. The external factors, on the other hand, may involve “norms of desirable behavior that exist in the society of which the organization is a part.”

6 Company’s culture has not change in this transition would likely affect the company both administratively and in the way company’s staff want to achieve the goals of the company. Increase service department gross profit may be the short-term strategy suitable for a company in Mr. Brokenhill industry, while the long-term strategy may be to improve sales. But you can only improve sales if you can be a good dealer in town.

7 Good communication represents a good strategy to relay the new company’s objectives and goals determined by Mr. Brokenhill among related departments’ managers. Effective practice in communicating goals and strategies requires repetitive experience and reinforcement, especially in automotive industry today; and in a market environment in which consumers demand more environmentally friendly atmosphere.

8 The lines along the company’s structure or chart depict the formal relationships among the department, the authority and responsibility of each department head. It depicts the information organization.

9 Every department wants to be profitable. It tends to be the perception of each department, which has been established to run on their own and become a profit center. This change requires the establishment of strategic planning with a formal control system, which includes the rules, physical controls, the manuals, system safeguards, task control system, and formal control process.

1 3. Many profit centers transfer products to other profit center within the company,” said Anthony and Govindarajan (2000, 54). In fact, as profit center, they emphasized their operation based on profitability.

2 General considerations to the creation of profit center should be the conditions for delegating profit responsibility such as the trade offs of decision making between each department (ie new car sales, used car sales, and service center). This trade offs provides organizational effectiveness and the second condition is that the manager should have access to the relevant information needed for a decision.

3 Mr. Brokenhill should be able to decide whether “he advantages of giving profit responsibility offset the disadvantages” (Ibid, 165). In fact, Anthony and Givindarajan describe that the establishment of division as profit center has been prevalent. However they have several advantages and disadvantages. The advantages, among others, improve quality of decision, speed the operating decision, relieved of day-to-day decision-making from headquarters management, managers have fewer restraints, they provide an excellent training ground for general management, enhance managers who are responsible for profits, and because their outputs are so readily measured, they can be very responsive.

4 The difficulties with profit center are decentralization of decision making will force top-management to rely more on management control report rather than on personal knowledge, friction may increase among departmental managers over transfer pricing, departments may become competitive and may impose additional costs because of additional labor cost or the perception to increase greater profit, “competent general managers may not exist in a functional organization” (Anthony & Givondarajan, 2000, 168), “too much emphasis on short-term profitability at the expense of long-run profitability” (Ibid), and lack organizational satisfaction.

5 As business units are created as profit centers, it requires profitability measurements to evaluate each profit center. This includes management performance and economic performance. The types of profitability measurements can be obtained from the analysis of the company’s overall contribution margin, direct profit, controllable profit, income before income taxes, and net income.

6 Therefore, Mr. Brokenhill could have improve the communication concerning the company’s goal and objectives and how the performance of each department can contribute to the company’s overall economic performance rather than competing among each other. All departments should increase performance and that their goals should also congruence to the goals of the company.

7

References

Anthony, Robert N. & Govindarajan, Vijay (2000). Management Control System. Tenth Edition. New York: McGraw-Hill-Irwin

Kieso, Weygandt, Irvine, Silvester, & Young (1997). Intermediate Accounting. Fifth Canadian Edition. Toronto: John Wiley & Sons Canada, Ltd.

Please add your own book as references as well

Appendix

EXHIBIT I

BROKENHILL AUTO INC.

Income Statement for the Year Ended December 31, 2004

Sales of new cars

3,821,875

Cost of new sales

3,156,405

Sales remuneration

162,370

3,318,775

503,100

Allowances on trade*

116,115

386,985

Sales of used cars

2,395,690

Appraised value of used cars

1,907,275

Sales remuneration

91,560

1,998,835

396,855

Allowances on trade*

61,115

335,740

722,725

Service sales to customers

347,510

Cost of work

256,985

90,525

Service work on reconditioning:

Charge

236,580

Cost

244,310

(7,730)

82,795

805,520

General and administrative expenses

491,710

Profit before taxes

313,810

*Allowances on trade represent the excess of amounts allowed on cars taken in

EXHIBIT 2

ANALYSIS OF SERVICE DEPARTMENT EXPENSES

FOR THREE MONTHS ENDED DECEMBER 31, 1993

Customer

Reconditioning

jobs

jobs

Total

Number of jobs

61

55

116

Direct labour

21,386

19,764

41,150

Supplies

7,412

6,551

13,963

Department overhead (fixed)

6,312

5,213

11,525

35,110

31,528

66,638

Parts

16,287

17,334

33,621

51,397

48,862

100,259

Charges made for jobs to customers or other departments

69,502

47,316

116,818

18,105

(1,546)

16,559

General overhead proportion

11,416

Departmental profit

5,143

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the case study on your topic

"Strategic Management Accounting: The Brokenhill Auto Ltd"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY