StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Wobbly Boot Crawls- Financial Feasibility Analysis

Free

Wobbly Boot Crawls- Financial Feasibility Analysis - Case Study Example

Summary

This study "Wobbly Boot Crawls- Financial Feasibility Analysis" discusses a financial feasibility analysis based on information provided in the business plan and certain assumptions and recommendations. The study analyses the financial performances of a similar businesses…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER98.2% of users find it useful

- Subject: Finance & Accounting

- Type: Case Study

- Level: Ph.D.

- Pages: 4 (1000 words)

- Downloads: 0

- Author: scot85

Extract of sample "Wobbly Boot Crawls- Financial Feasibility Analysis"

Wobbly Boot Crawls- Financial Feasibility Analysis Introduction The Entrepreneur Business opportunity (EBO) under consideration is cash based servicetouring facilities through Sydney’s CBD to young people who are backpackers, partygoers, and limited budget tourists. A financial feasibility analysis based on information provided in business plan and certain assumption and recommendation is undertaken in this analysis.

Initial Capital Requirements

Any business requires start up capital for two purposes. First to acquire capital assets required for the starting the business and secondly working capital to ensure smooth functioning of normal business activities. As per Lawrence J. Gitman (2006, page G 20)1 working capital involve ‘current assets, which represent the portion of investment that circulate from one form to another in ordinary conduct of business’. Initial capital requirements of $2000 as envisaged seem unrealistic because of the following reasons:

Even though it is assumed that bookings for tour would be done through websites or on personal visits at hostels and other places promoting the business, but still an office is required. It may be assumed that office may be taken at a convenient place on monthly rent basis of say $1000 per month and at least first two months rent should be included in the initial capital requirements.

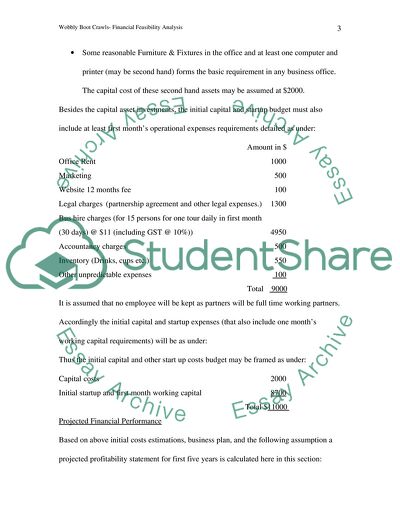

Some reasonable Furniture & Fixtures in the office and at least one computer and printer (may be second hand) forms the basic requirement in any business office. The capital cost of these second hand assets may be assumed at $2000.

Besides the capital asset investments, the initial capital and startup budget must also include at least first month’s operational expenses requirements detailed as under:

Amount in $

Office Rent 1000

Marketing 500

Website 12 months fee 100

Legal charges (partnership agreement and other legal expenses.) 1300

Bus hire charges (for 15 persons for one tour daily in first month

(30 days) @ $11 (including GST @ 10%)) 4950

Accountancy charges 500

Inventory (Drinks, cups etc.) 550

Other unpredictable expenses 100

Total 9000

It is assumed that no employee will be kept as partners will be full time working partners.

Accordingly the initial capital and startup expenses (that also include one month’s working capital requirements) will be as under:

Thus the initial capital and other start up costs budget may be framed as under:

Capital costs 2000

Initial startup and first month working capital 8700

Total $11000

Projected Financial Performance

Based on above initial costs estimations, business plan, and the following assumption a projected profitability statement for first five years is calculated here in this section:

Assumptions

1. Revenue:

There will be 25 working days in a month with one tour in first year making it as 300 tours in first year for 15 persons on each tour at tour fee each person of $25.

In second year two tours will be operated in a day for average 20 persons in each tour. Thus there will be 600 tours in second year at tour fee each person of $25. From third year on wards there will be approximately 20% increment in revenue each year as compared to previous year.

2. Bus fare each tourist will be $11 in first and that will rise by 15% each year comparing previous year.

3. Two employees at salary of $2000 will be employed from second year and their wages will go up by 15% each year comparing previous.

4. Other expenses each year will rise by 15% except rent that is assumed to be fixed for a five year lease.

5. Estimated useful life of capital assets is 5 years with no salvage value, and straight line depreciation will be charged.

6. Interest at the rate 12% will be charged on initial capital investment of $10700.

7. GST at 10% is charged to GST Recoverable account and thus not included in the expenses

8. Tax rate is 30% all inclusive.

Financial performances of similar business

Business plan reflects three competitors, namely Route 69 Bus Tours, Sydney Party Bus, and Katika Fun Boat Cruises and they charge $40, $66, and $ 49 respectively per tour. In addition they provide certain extra facilities to tourists. As these competitors are not listed companies, it is not possible to obtain their financial statements. Accordingly in order to analyze the performance of competitors in comparison with projected profitability statement of Woobly Boot Crawls, some researched analysis is presented on basis of certain assumptions. Let us assume that their inventory costs are 20% more than costs estimated above for Wobbly Boot Crawls Also that ratio of profit before taxation (PBT) is the same as calculated above for Woobly Boat Crawls. Accordingly the financial performances of each competitor are projected here under:

The comparisons of projected PAT of competitors with that of Woobly Boat Crawls reveals that there is lot of scope for number of players in the market as every entity would be serving a distinct section of the visitors, as Woobly Boat Crawls would serve the

Attractiveness of the proposal

The EBO is cash based service providing venture, and hence does not require funds to be invested in accounts receivables.

The proposal to serve backpackers, young partygoers, and limited budget tourists is exclusivity as competitors do not serve exclusively to this sector.

The ticket price is lowest among all competitors and this is bound to bring more and regular business.

Though not accounted for in above projections the promoters can make arrangement with specific pubs and clubs to take tourists there and earn incentives.

Capital cost and initial startup cost as planned in this write-up is reasonable considering the infrastructural facilities other competitors might be having.

Financial factors associated with promising business opportunities

Initial start up cost of $2000 as provided in business plans is not practicable. Capital and initial costs of $11000 as planned in this write up is one of the major financial consideration.

The factor of maintaining lowest ticket price among competitors may fetch low margins till the project operates at desirable capacity.

Working partners has to forgo remuneration in the first year when employees will not be recruited.

Interest cost of capital investment is another financial factor to be considered.

Recommendations

This EBO is highly recommended provided partners are in a position to arrange initial capital requirements. Success of the business heavily depends upon partners’ working in the first year when they will be operating without employees. This is also an investment in the shape human resource contribution from partners. Moreover the business is profitable right from first year even after meeting the interest on capital employed.The business is also recommended as the sector of backpackers, young partygoers, and tourists with limited budget is large enough to accommodate a number of players, and the competitors are not exclusively catering to this sector.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the case study on your topic

"Wobbly Boot Crawls- Financial Feasibility Analysis"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY