StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Investment Decisions at Dixions Retail Plc

Free

Investment Decisions at Dixions Retail Plc - Coursework Example

Summary

In the paper “Investment Decisions at Dixons Retail Plc,” the author examines investment decisions, which are utilized in most productive manner and provide the returns required by the shareholders. Dixons Retail Plc is one of the leading retail chains providing electronic products…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96.5% of users find it useful

- Subject: Finance & Accounting

- Type: Coursework

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

Extract of sample "Investment Decisions at Dixions Retail Plc"

Investment Decisions at Dixions Retail Plc

a) Investment decisions are made in order to ensure that the firm’s assets are utilized in most productive manner and that they provide the returns required by the shareholders. Dixions Retail Plc (firm) is one of the leading retail chains providing electronic products across different countries. Its investment activities and changes over the period of last few years indicate following picture:

In Millions

Year

2006

2007

2008

2009

2010

Total Non Current Assets

2025.7

1909.6

1814.2

1955.7

2042

Total Called up Share Capital

45.6

46.1

44.3

44.3

90.2

Total Non Current Borrowing

301.1

290.4

294.6

322.5

321.4

These figures indicate that the firm has been able to increase its investment activities only recently i.e. it’s called up capital and total non-current borrowing almost remained same during the period. A look at the cash flow statement of the firm suggests that the firm has recently invested into purchase of property plant and equipments besides purchasing the subsidiaries. This shows that the firm has engaged itself into acquisitions of new businesses in the recent past.

What is also significant to note that firm’s total non current borrowing has increased suggesting that the overall risk profile of the firm may have increased in the recent past. This is also evident from the decline in the share prices of the firm wherein the firm’s share prices have declined owing to the low growth in sales as well as higher debt used in financing the overall capital structure of the firm.

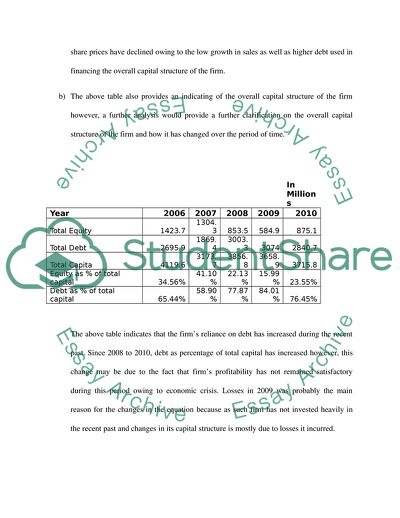

b) The above table also provides an indicating of the overall capital structure of the firm however, a further analysis would provide a further clarification on the overall capital structure of the firm and how it has changed over the period of time.

In Millions

Year

2006

2007

2008

2009

2010

Total Equity

1423.7

1304.3

853.5

584.9

875.1

Total Debt

2695.9

1869.4

3003.3

3074

2840.7

Total Capita

4119.6

3173.7

3856.8

3658.9

3715.8

Equity as % of total capital

34.56%

41.10%

22.13%

15.99%

23.55%

Debt as % of total capital

65.44%

58.90%

77.87%

84.01%

76.45%

The above table indicates that the firm’s reliance on debt has increased during the recent past. Since 2008 to 2010, debt as percentage of total capital has increased however, this change may be due to the fact that firm’s profitability has not remained satisfactory during this period owing to economic crisis. Losses in 2009 was probably the main reason for the changes in the equation because as such firm has not invested heavily in the recent past and changes in its capital structure is mostly due to losses it incurred.

c) Firm has no paid any dividends during 2009 and 2009 however, it continued to paid dividends from 2006 to 2008. 1 Lack of dividend payments may be attributed to the losses which firm has incurred during the recent past and its unsatisfactory performance.

These policy areas are related with each other because if the firm is not able to pay dividends consistently it may not be able to raise the funding from capital markets and resultantly it has to look for other more expensive sources of debts to finance its expansion. In this situation, this has exactly happened as the firm is relying heavily on the debt and its internally generated equity to finance its future expansion and make new strategic investments in order to ensure that it can face the future challenges easily.

Task-2

Year

3/5/2008

2/5/2009

1/5/2010

Market Price

0.6925

0.4125

0.331

No of Shares in Issue

1772.442

1772.442

3609.937

Dividends Paid

5.54

0

0

Market Value

1,227.42

731.13

1,194.89

Book value of shares

853.50

584.90

875.10

Market value added

373.92

146.23

319.79

Market book value Ratio

1.44

1.25

1.37

Return on Equity

9.80%

6.55%

Task 3

a) The firm’s capital structure indicates that it is heavily reliant on the external debt therefore its overall riskiness may increase if the same patterns continue to exist. Though the firm’s market book value ratio has improved during 2010 however, it still requires consistency in its performance and further rationalize its capital structure in order to ensure that its overall debt profile is within the acceptable range. Higher debt levels though may provide tax and other advantages to the firm however, a consistently higher level of debt may ultimately increase the risk for the firm and the overall investment prospects may not remain good.(Atrill, 2009)

b) Return on equity has declined during 2010 indicating the managers may not have been entirely successful in generating the value for the shareholders. Further, the firm has not paid any dividends during the recent past thus further dampening the spirit of the investors. In order to generate value, it is critical for the firm’s managers to ensure that they generate enough wealth for the existing shareholders which can serve as a signal for external shareholders to buy firm’s stocks and ultimately result into the increase in the share prices of the firm.

c) The recent trends in the share prices indicate that the firm may have been falling victim of the current economic situation prevailing in the country. Since 2007, UK is going through recession and overall consumer spending has declined since than. This decline in the consumer spending therefore may have contributed towards the low sales growth as well as low growth in profitability of the firm.

Apart from the low growth in both the sales and profitability, it seems that the firm has not been able to manage its debt properly. Higher debt levels may ultimately serve as a signal to the external investors that the firm may be finding it hard to raise external equity to fund its expansion. Apart from this, firm has not shown any kind of expansion in recent past and lack of the expansion may also have served as a strong signal for the shareholders. It is critical to note that making strategic investments provides external stimulus to the shareholders to start looking into the firm’s future prospects from a more positive outlook.

References

P. Atrill (2009) Financial Management for Decision Makers, FT/Prentice Hall, p89

Read

More

CHECK THESE SAMPLES OF Investment Decisions at Dixions Retail Plc

Financial Analysis for Dixons Retail

The company has over 38,000 employees and it holds the number 1 position in the UK & Ireland, Greece, Nordics, and the Czech Republic (Dixons retail plc, 2011).... mportant information related to these four divisions is given below in the table (Dixons retail plc, 2011).... (London Stock Exchange plc, 2011).... The essay "Financial Analysis for Dixons retail" focuses on the critical analysis of the major issues in the financial analysis for Dixons retail, the largest electrical and computing retailer in Europe....

13 Pages

(3250 words)

Essay

Resource Management. Tesco PLC

A Brief Overview of the Organisation Tesco plc, a United Kingdom based multinational business corporation is regarded as one of the foremost leaders in establishing retail chain stores throughout the globe.... The organisation can be viewed to possess numerous retail chain stores in different parts of the globe with a handful of competent employees performing various operational functions in an effective manner....

8 Pages

(2000 words)

Essay

The Marketing Planning Process for Dixons Retail Plc

The paper "The Marketing Planning Process for Dixons retail plc" discusses that Dixons retail plc is an international retail and service operation with more than one hundred million customers, both online and in its stores.... In this case, Dixons retail plc reviewed all the product ranges and target markets.... Dixons retail plc expanded into Ireland, Greece and the Czech Republic to become Europe's largest specialist electrical retailer and services company (Jobber & Ellis-Chadwick, 2012, p, 66)....

12 Pages

(3000 words)

Case Study

Principles and Practice of Marketing of Dixon Retail Plc

The object of analysis for the purpose of this paper "Principles and Practice of Marketing of Dixon retail plc" is Dixons retail plc as one of the most renowned expert electrical retailers from the UK.... The retail chain started out as a photography business and slowly it grew into a high street store, selling not only photographic equipment but also other electrical appliances.... Dixons was a product-oriented company when it started its journey in the electrical retail segment....

10 Pages

(2500 words)

Case Study

Business Strategy and Strategic Management: Tesco

"Business Strategy and Strategic Management: Tesco" paper focuses on Tesco plc that is regarded as the UK's largest food retailer that operates in excess of 2318 stores across the globe and employs over 520,000 people who are significantly engaged in serving millions of customers every week.... % that amounted to £72 billion and thus attained superior competitive industry in the related industry (Tesco plc, 2012).... Thus, on the basis of the above discussion, it can be stated that the mission statement of the company implies creating value for the customers for gaining their lifetime reliability by a considerable level (Tesco plc, 2011)....

19 Pages

(4750 words)

Case Study

The Sourcing, Budgeting Procedures and Financial Reporting Requirements of Tesco PLC

"The Sourcing, Budgeting Procedures and Financial Reporting Requirements of Tesco plc" paper focus on procedures rather than detailed accounts or quantification of the data available relating to the aforesaid organization.... esco plc, a United Kingdom-based multinational business corporation is regarded as one of the foremost leaders in establishing retail chain stores throughout the globe....

9 Pages

(2250 words)

Case Study

Business Strategy of Marks and Spencer

The main objective of this study is to discuss the strategic positioning and target market of Marks & Spenser plc.... This has made survival in the retail industry challenging (Marks & Spencer plc, 2014).... arks & Spenser designed a business model that would help them to face challenges in the retail market and also mitigate risk....

7 Pages

(1750 words)

Case Study

Strategic and Competitive Advantages of Next

he current paper evaluates how Next plc develops their core strategies so that they are able to cope up with change and maintain a competitive position in the market.... 1: Discussion on Strategic management Defining strategy The strategy may be defined as the set of plans and decisions which guide an organization towards the achievement of their earlier set organizational missions and visions....

10 Pages

(2500 words)

Report

sponsored ads

Save Your Time for More Important Things

Let us write or edit the coursework on your topic

"Investment Decisions at Dixions Retail Plc"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY