StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- The Petty Cash Fund Internal Control

Free

The Petty Cash Fund Internal Control - Case Study Example

Summary

This paper "The Petty Cash Fund Internal Control" analyzes that the petty cash fund internal control topic focuses on ensuring the safeguarding of the petty cash fund of Linstead Parva Plc. The research focuses on finding the internal control weaknesses…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER99% of users find it useful

- Subject: Finance & Accounting

- Type: Case Study

- Level: Undergraduate

- Pages: 4 (1000 words)

- Downloads: 0

- Author: brad45

Extract of sample "The Petty Cash Fund Internal Control"

Internal Control – Petty Cash Fund Inserts His/Her Inserts Grade Inserts 8 April The petty cash fund internal control topic focuses ensuring the safeguarding of the petty cash fund of Linstead Parva Plc... The research focuses on finding the internal control weaknesses. The research delves into recommending actions to improve the company’s internal control on cash (Weygandt, 2009). A strong internal control will reduce or even wipe out theft of petty cash funds.

Internal Control Weakness

Recommendation

Chief Internal Auditor reports to Finance Director.

The Chief internal auditor should report to the board of directors. The Chief Internal auditor should audit if the Finance Director is involved in any fraudulent activity relating to cash (Weygandt, 2009).

Petty Cash is kept in a lockable box on bookcase in the accounts office. It is easy to steal the lockable box and ferry it away.

Petty cash box should be kept in a vault or safe place to avoid theft.

Vouchers for expenditure are signed by the person incurring that expense. There is no approval for the vouchers.

There should be segregation of responsibilities. One person will approve the vouchers. The first person may be the supervisor or manager.

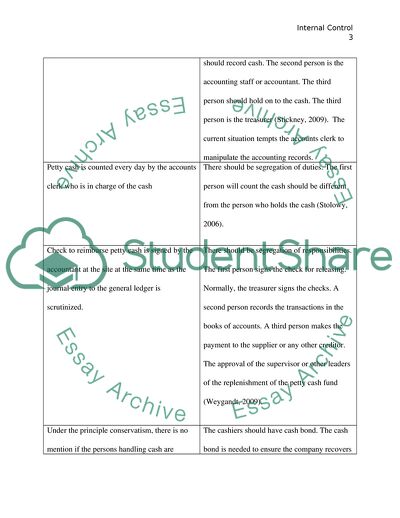

Petty cash vouchers are recorded in the petty cash book by the accounts clerk.

There should be segregation of duties. The first person will receive cash. The first person should be the cashier. The second person should record cash. The second person is the accounting staff or accountant. The third person should hold on to the cash. The third person is the treasurer (Stickney, 2009). The current situation tempts the accounts clerk to manipulate the accounting records.

Petty cash is counted every day by the accounts clerk who is in charge of the cash

There should be segregation of duties. The first person will count the cash should be different from the person who holds the cash (Stolowy, 2006).

Check to reimburse petty cash is signed by the accountant at the site at the same time as the journal entry to the general ledger is scrutinized.

There should be segregation of responsibilities. The first person signs the check for releasing. Normally, the treasurer signs the checks. A second person records the transactions in the books of accounts. A third person makes the payment to the supplier or any other creditor.

The approval of the supervisor or other leaders of the replenishment of the petty cash fund (Weygandt, 2009).

Under the principle conservatism, there is no mention if the persons handling cash are bonded.

The cashiers should have cash bond. The cash bond is needed to ensure the company recovers cash shortages or cash theft by the cashiers. In addition,

Under the principle of conservatism, there is no mention if the cashiers or accounting clerks take a much-needed vacation.

The cashiers and other persons handling cash are required to take a vacation. During vacation, management makes cash counts and compares the records of the cashier with the records on file (Weygandt, 2009).

There is no mention if the policy “Only authorized persons are allowed to enter the cashiers’ office”.

Only authorized persons are allowed to enter the cashiers’ office. This action will prevent unauthorized persons from stealing cash and other scarce assets from the petty cash custodian’s location.

In addition, the company can hire security guards to allow only authorized persons to enter the premises.

Under the principle conservatism, there is no mention if daily cash count is counted.

The supervisor or other superior company officer will perform regular cash counts to determine if there is fraud or error. The regular cash counts will ensure that the cashier is not having a shortage or overage. Shortage occurs when the amount of counted cash is less than the amount stated in the official receipts, and other legal documents. The overage occurs when the total cash counted is more than the total amount stated from the official receipts and other legal documents. In case of a cash shortage, the amount shall be deducted from the cashier or other person in charge of handling cash.

There is no mention if the imprest system of recording cash in the petty cash fund.

The company must institute the imprest system of recording the petty cash fund. Under the fluctuating cash system, the total cash per count, receipts, and other legal documents will always equal the total petty cash amount.

There is no mention about the details of the petty cash disbursements.

The petty cash disbursement vouchers should indicate the amount paid, the purpose of the withdrawal, and the signatures of both the person receiving the cash and the cashier or cash custodian. With the above procedure in place, the supervisor or any superior officer can easily trace if the petty cash fund is a reality or a fraudulent transaction. Likewise, the supervisor or the superior officer can determine if the petty cash voucher payment was done for a real transaction by looking at the signature of the payee on the voucher.

There is no mention of petty cash funds being separated from other cash funds in the company.

The petty cash fund should be held as a separate account classification from the other cash funds of the company.

The average petty cash balance of each branch si £50,000.

The petty cash fund should be reduced to a lower figure. All amounts exceeding the lower limit (should be lesser than £50,000) shall be classified under another the main cash classification). Payments made from the other cash classification shall be in form of checks.

The company should issue checks for the amount equal the creditor’s statements of accounts.

There is no mention if the vouchers were stamped paid after the creditor or collector received the payments.

The cashiers should stamp the word “paid” on all vouchers to indicate the vouchers had been paid. The stamp is a reminder to the cashier that the voucher had already been paid.

Under the principle of conservatism, there is no mention of employees cashing their personal checks from the company’s petty cash fund.

The company should set up a policy stating all employees should not cash their checks from the petty cash fund. Doing so, the company may find itself out of available cash on hand when an emergency situation arises. In a worst case scenario, some of the employees may cash their personal checks with an amount equal to the company’s cash on hand. If the personal checks were cashed from the petty cash fund, the company will not have enough cash to pay the emergency cash requirements of the company.

Based on the above discussion on the petty cash internal control, the research centers the importance of determining the internal control weaknesses. The research delves into recommending actions to improve the company’s internal control procedures. The procedures focus on the company’s petty cash fund. A strong internal control will reduce or even wipe out theft of petty cash fund on corruption. Indeed, the petty cash fund internal control procedures ensure the safeguarding of the company’s petty cash fund.

References

Weygandt, J., (2009) Accounting Principles. London: J. Wiley & Sons.

Stickney, C. (2009) Financial Accounting. London: Cengage Press.

Stolowy, H. (2006) Financial Accounting and Reporting. London: Thompson Press.

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the case study on your topic

"The Petty Cash Fund Internal Control"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY