StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Fingask Estates: Capital Budgeting

Free

Fingask Estates: Capital Budgeting - Case Study Example

Summary

The paper "Fingask Estates: Capital Budgeting" is a brilliant example of a case study on finance and accounting. Fingask Estates is a medium-sized agricultural company based in Scotland. It is involved in the production and selling of a wide range of agricultural crops and the rental of rivers and moorland for sport fishing and shooting…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER96.2% of users find it useful

- Subject: Finance & Accounting

- Type: Case Study

- Level: Undergraduate

- Pages: 5 (1250 words)

- Downloads: 0

- Author: stammmiguel

Extract of sample "Fingask Estates: Capital Budgeting"

Fingask E s: Capital Budgeting Fingask E s is a medium sized agricultural company based in Scotland. It is involved in production and sellingof a wide range of agricultural crops and the rental of rivers and moorland for sport fishing and shooting. Currently, the management is contemplating on a plan to invest in wind turbines which will generate electricity. The potential plan is auspicious for the organization as it will provide ultimate benefits by increasing company’s revenue and reducing company’s electricity costs. In addition to that, the management is optimistic that it will receive a capital grant from the government once it will commence the project.

Details of the Project

Cost

£1,800,000

Capital Grant (40%)

£720,000

Initial Capital Outlay

£1,080,000

The management is expected to receive a capital grant of 40% of the actual capital cost therefore the initial capital outlay for the company will be £1,080,000.

Project Life

15 Years

Cost

£1,800,000

Depreciation Charge per Annum

£120,000

Depreciation has been calculated on straight line basis and it will be constantly recognized over the life of the project.

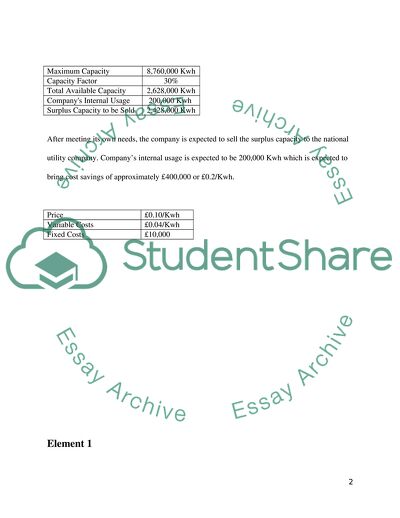

Maximum Capacity

8,760,000 Kwh

Capacity Factor

30%

Total Available Capacity

2,628,000 Kwh

Companys Internal Usage

200,000 Kwh

Surplus Capacity to be Sold

2,428,000 Kwh

After meeting its own needs, the company is expected to sell the surplus capacity to the national utility company. Company’s internal usage is expected to be 200,000 Kwh which is expected to bring cost savings of approximately £400,000 or £0.2/Kwh.

Price

£0.10/Kwh

Variable Costs

£0.04/Kwh

Fixed Costs

£10,000

Element 1

Annual Profit before Taxation

Surplus Units

2,428,000

Price per Unit

£0.10/Kwh

Revenues

£242,800

Total Units

2,628,000

Variable Cost per Unit

£0.04/Kwh

Variable Costs

£105,120

Revenues

£242,800

Less: Variable Costs

£105,120

Add: Cost Savings

£40,000

Gross Profit

£177,680

Depreciation Expense

£120,000

Fixed Cost

£10,000

PBT

£47,680

Based on the annual profit before taxation criteria, the project seems to increase the current profit before tax figure by £47,680 therefore it is positive value addition for the company.

Annual Cash Flows

PBT

£47,680

Add: Depreciation

£120,000

Annual Cash Inflow

£167,680

Assuming that the tax rate for the company is 0%, than the project adds £167,680 annually to the cash flows for the life time of the project.

Break Even Analysis & Margin of Safety

The number of surplus units where Profit before tax figure becomes 0, will be the breakeven point of the project.

Maximum Capacity

8,760,000

Capacity Factor

20.93%

Total Available Capacity

1,833,333

Surplus Capacity

1,633,333

Surplus Units

1,633,333

Price per Unit

£0.10/Kwh

Revenues

£242,800

Total Units

1,833,333

Variable Cost per Unit

£0.04/Kwh

Variable Costs

£105,120

Revenues

£163,333

Less: Variable Costs

£73,333

Add: Cost Savings

£40,000

Gross Profit

£130,000

Depreciation Expense

£120,000

Fixed Cost

£10,000

PBT

0

The above analysis entails that the wind turbine should at least generate 1,833,333 units of electricity in order to become profitable. It also implies that the turbine should not operate at a capacity factor lesser than 20.93%.

The margin of safety for the above project is

= (242,800 – 163,333) / 242,800

Margin of Safety = 32.73%

Payback Period

Cost

£1,800,000

Capital Grant (40%)

£720,000

Initial Capital Outlay

£1,080,000

PBT

£47,680

Add: Depreciation

£120,000

Annual Cash Inflow

£167,680

Simple Payback Period = Initial Outlay / Annual Cash inflow

= 1,080,000 / 167,680 = 6.44 Years

Element 2

Executive Summary

Fingask Estates is a mid size agricultural company producing and selling a wide range of agricultural crops and rental of rivers and moorland for sport fishing and shooting. To change the fortunes of the company, the management has planned to invest in wind turbines which will allow the company to produce electricity. The electricity will be utilized for internal electricity generation and the surplus capacity will be sold to a national utility company. The project will result in potential cost savings and will boost the revenues of the company.

Capital expenditures for the project amount to £1,800,000; however, the management is expected to receive a capital grant of 40% reducing the initial capital outlay for the company to £1,080,000. Company’s internal usage is expected to be 200,000 Kwh which is expected to bring cost savings of approximately £400,000. The surplus capacity of 2,428,000 will be sold to the national electricity grid, producing an additional £242,800 in revenues. At a cost of capital of 10%, the project has a positive NPV of £195,387, resulting in a positive value addition. The proposal should be accepted as the project adds value to the company’s wealth.

As it has been heard that there is a growing lobby in the European Parliament which is planning to restrict both the award and value of the capital grant for agricultural enterprises, the fortunes of the project are jeopardized. The sensitivity analysis shows that at any capital grant lesser than 29.13% of the cost, the project is not viable and should not be accepted. It is therefore imperative for the business to ascertain that the current capital grant will be provided to the company.

NPV Analysis

The table below shows cash flows from the project during its life time. The initial capital outlay incorporates the impact of capital grant of 40% provided by the government. To calculate the NPV of the project, we discount all the cash inflows at 10% at each year.

0

-£1,080,000

1

£167,680

2

£167,680

3

£167,680

4

£167,680

5

£167,680

6

£167,680

7

£167,680

8

£167,680

9

£167,680

10

£167,680

11

£167,680

12

£167,680

13

£167,680

14

£167,680

15

£167,680

NPV = -1080000 + 167680/(1.10)1 + 167680/(1.10)2 + 167680/(1.10)3 + 167680/(1.10)4 + ……………………..+ 167680/(1.10)14 + 167680/(1.10)15

NPV = £195,387

At a discount rate of 10%, the project has a NPV of £195,387 therefore it should be accepted. The project has a net positive addition to the value of the company.

Sensitivity Analysis

Variable Costs:

Variable Cost per Kwh

NPV

0.044

115,432

0.048

35,477

0.052

(44,478)

0.056

(124,433)

0.060

(204,388)

The project is most sensitive to the estimates of variable costs as a 10% increase in variable costs can reduce the NPV of the project by £79,955.

Capacity Factor:

Capacity Factor

NPV

22%

(124,433)

23%

(84,455)

24%

(44,478)

25%

(4,500)

26%

35,477

27%

75,455

28%

115,432

The project is highly sensitive to the capacity factor of wind turbine as a 1% decrease in capacity factor can reduce the NPV of the project by £39,677. Therefore the estimate of the capacity factor should be measured through reliable means.

Capital Grant:

Capital Grant

NPV

20%

(164,613)

30%

15,387

40%

195,387

50%

375,387

60%

555,387

The project’s success also depends on the capital grant provided to the company, as the sensitivity analysis shows that at a capital grant of approximately less than 30%, the project is not viable.

Analysis of Business Context Factors on the Investment Decision:

The project provides a convenient mechanism for electricity generation making the business self dependent. However, the major portion of the benefits from the project stem from surplus generation to the national utility company. Hence, it is imperative for the business to evaluate whether they will easily meet the potential capacity at a rate of 30% or not. The sensitivity analysis performed above shows that the project is highly sensitive to the capacity factor, therefore, the feasibility study should provide guaranteed results with respect to the capacity of wind turbine.

The second issue arises from the capital grant to be obtained from the EC. Although, the company is confident that it will qualify for the “green energy” grant, but there is a growing lobby in the European Parliament which is planning to restrict both the award and value of this grant for agricultural enterprises. Hence, it should be made certain that the company will receive the capital grant, as the project deems to be unviable without the availability of the capital grant.

Appendix

Strengths & Weakness of the Financial Techniques Used

The Profit before tax method is an accounting measure which does not provide the real cash flows derived from the project, therefore, it is technically flawed while evaluating any project. Similarly, the simple payback period does not incorporate the opportunity cost of capital while evaluating the project. It only provides a time frame through which the initial capital will be recovered. Hence, its drawback outshines its benefit and therefore should not be used for capital budgeting decisions.

Net Present Value analysis is the best financial technique which incorporates the values of real cash flows and the concept of time value of money. The longer the time horizon on which cash flows will be generated, the lower will be its value. The decision based on NPV analysis provides the best outcome in terms of viability and value addition.

Bibliography

Hill, R. A. 2008, Strategic Financial Management, Ventus Publishing: UK

Welch, H. 2009, Corporate Finance: An Introduction: Prentice Hall: New York

Read

More

sponsored ads

Save Your Time for More Important Things

Let us write or edit the case study on your topic

"Fingask Estates: Capital Budgeting"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY