StudentShare

Our website is a unique platform where students can share their papers in a matter of giving an example of the work to be done. If you find papers

matching your topic, you may use them only as an example of work. This is 100% legal. You may not submit downloaded papers as your own, that is cheating. Also you

should remember, that this work was alredy submitted once by a student who originally wrote it.

Login

Create an Account

The service is 100% legal

- Home

- Free Samples

- Premium Essays

- Editing Services

- Extra Tools

- Essay Writing Help

- About Us

✕

- Studentshare

- Subjects

- Finance & Accounting

- Financial Statement Analysis and Finance Performance: Agroproquim, C.A

Free

Financial Statement Analysis and Finance Performance: Agroproquim, C.A - Case Study Example

Summary

The "Financial Statement Analysis and Finance Performance: Agroproquim, C.A." paper includes financial ratio analysis along with a presentation of various key performance indicators that have been derived for the assessment of the company’s financials…

Download full paper File format: .doc, available for editing

GRAB THE BEST PAPER97.9% of users find it useful

- Subject: Finance & Accounting

- Type: Case Study

- Level: College

- Pages: 4 (1000 words)

- Downloads: 0

- Author: sluettgen

Extract of sample "Financial Statement Analysis and Finance Performance: Agroproquim, C.A"

Agroproquim, C.A. Agroproquim, C.A. Introduction The case of Agroproquim, C.A. is under consideration in this report. The company has its business in the distribution of chemical products for the agricultural industry. The company despite of growth in sales is not able to maintain healthy cash position, which is resulting in delayed payments to suppliers and thus, affecting the ability of the business to keep up with its finances and also to meet the requirements of its sales. Moreover, there have been delays in the collection of the company’s accounts receivables which in effect combined with other factors is making the financial and business position of the company weak. The current situation has led to refusal of additional financing from Banco Oriental. In this report the company’s financial position has been evaluated. For this purpose, in this report cash flow statement for the last year 2008 has been prepared to determine cash flow from operations, investment, and finance activities. In addition, the report also includes financial ratio analysis along with presentation of various key performance indicators which have been derived for the assessment of the company’s financials.

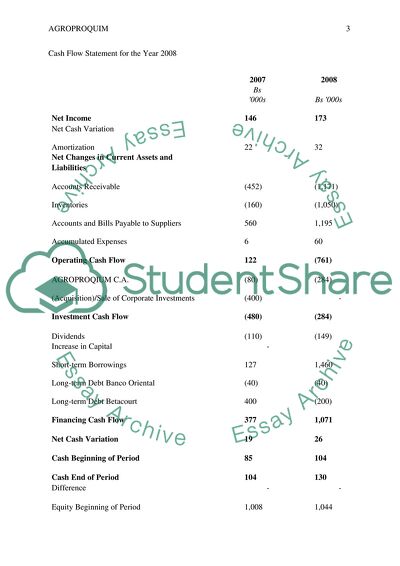

Cash Flow Statement for the Year 2008

2007

2008

Bs 000s

Bs 000s

Net Income

146

173

Net Cash Variation

Amortization

22

32

Net Changes in Current Assets and Liabilities

Accounts Receivable

(452)

(1,171)

Inventories

(160)

(1,050)

Accounts and Bills Payable to Suppliers

560

1,195

Accumulated Expenses

6

60

Operating Cash Flow

122

(761)

AGROPROQIUM C.A.

(80)

(284)

(Acquisition)/Sale of Corporate Investments

(400)

-

Investment Cash Flow

(480)

(284)

Dividends

(110)

(149)

Increase in Capital

-

-

Short-term Borrowings

127

1,460

Long-term Debt Banco Oriental

(40)

(40)

Long-term Debt Betacourt

400

(200)

Financing Cash Flow

377

1,071

Net Cash Variation

19

26

Cash Beginning of Period

85

104

Cash End of Period

104

130

Difference

-

-

Equity Beginning of Period

1,008

1,044

Net Income

146

173

Dividends

(110)

(149)

Equity End of Period

1,044

1,068

Difference

-

-

Dividends paid in the year 2008 are calculated by determining the difference adding up equity at the beginning of period and net income and deducting equity at the end of period.

CASH FLOW

2007

2008

Operating Cash Flow

122.00

(761.00)

Investment Cash Flow

(480.00)

(284.00)

Financing Cash Flow

377.00

1,071.00

The above table indicates very weak position of the company as it can be noted that the company’s operations are generating major cash outflows in the year 2008 as compared to the inflow in the year 2007. The company’s short term borrowing has been increased by Bs. 1,460,000 in 2008, which could lead the company into solvency issues if it continues to fail to generate positive cash flow from its operations as repayments of principal amount along with interest will become a difficult proposition for the company.

Financial Ratio Analysis

2006

2007

2008

LIQUIDITY

Current Ratio

1.9

1.3

1.0

Acid Test

0.8

0.7

0.5

Working Capital

822

560

92.0

DEBT

Total Assets/Equity

2.2

3.2

5.4

EBITDA/Interest

2.5

1.9

1.8

Total Debt

1.7

2.1

INTEREST RATIO

EBITDA/Interest

2.5

1.9

1.8

Operating Cash Flow/Interest

N/A

1.4

(1.9)

PROFITABILITY

Gross Profit/Sales

30%

28%

28%

Operating Profit/Sales

7%

8%

8%

Net Profit/Sales

2%

2%

2%

Net Profit/Total Assets

6%

4%

3%

Net Profit/Equity

14%

14%

16%

EBITDA/Sales

7%

8%

8%

EBITDA/Total Activo

18%

17%

12%

GROWTH

Variation in Sales

N/A

19%

30.0%

Variation in Total Assets

N/A

49%

75.4%

Variation in Total Liabilities

N/A

87%

109.0%

Variation in Equity

N/A

4%

2.3%

ACITIVITY / EFFICIENCY

Turnover Accounts Receivables (Days)

43

60

93

Turnover Inventory (Days)

88

84

124

Turnover Accounts Payable (Days)

39

73

124

Cash Turnover

92

71

70

Sales/Assets

2.62

2.1

1.55

(Note: The highlighted ratio is not complete because the name of the ratio is incomplete)

Liquidity

The company’s liquidity position is ascertained by three different measures of performance. It can be noted that the company’s liquidity position is deteriorating in the past three years. The current ratio which had values of 1.9 and 1.3 in 2006 and 2007 respectively has decline to value of just 1.0 in 2008. Although, this is still close to 1 which is a good indicator of liquidity. But by looking at the composition of the company’s current assets it is clear that the company is holding a large value of inventory which is reflected from the values attained for acid test ratio. This ratio has values less than 1 in all past three years and it is just 0.5 in 2008. This could lead to serious liquidity issues for the company as it is not able to generate sufficient cash flows and in case of any obligation settlement requirements the company could face liquidation or bankruptcy.

Capital Structure

Capital sturucture/leverage: compare short term and long term debt. How could the debt structure be improved?: one paragraph discussion

Dividend Payout Analysis

The company’s dividend payout ratio, which is calculated as the fraction of the net income paid as dividend to the company’s shareholders, has increased from 75% in 2007 to 86% in 2008. The resultant retention of the company has reduced from 25% in 2007 to 14% in 2008. This is one indicator of low cash holding by the company as it is paying very high levels of dividends payouts in both years instead of retaining these funds for improving the position of the company’s financial books and also maintaining continuous relationship with its suppliers. The company can delay or avoid paying to shareholders for coming periods in order to attain a higher cash level.

Sustainable Growth

The company’s sustainable growth is the measure of its ability to operate without increasing its financial leverage. It is calculated using the following formula;

Return on Equity x (1-Dividend Payout Ratio)

Return on Equity

Dividend Payout Ratio

Sustainable Growth Rate

14%

75%

11%

16%

86%

14%

The company’s sustainable growth rates for 2007 and 2008 are obtained as 11% and 14%. This is maximum growth that the company can achieve from its internal financing. However, when these ratio values are compared with variations in sales it is clear the company is experiencing more than ordinary growth in its sales and therefore, in order to meet its business requirements it must borrow from external sources, which is not being approved by Banco Oriental.

Operating efficiency and activity: one paragraph discussion on operating efficiency.

Operating performance and profitability: provide the profitability indicators and DuPont analysis: present a one paragraph discussion of your analyses and the indication of the firm’s returns on capital, equity, and assets.

1. Provide a summary of overall conclusions and recommendations.

Read

More

CHECK THESE SAMPLES OF Financial Statement Analysis and Finance Performance: Agroproquim, C.A

Financial Statement Analysis

financial statement analysis

... The paper has been undertaken under several topic which will make it more elaborate and informative and these will include company profile, market position, company ownership, economic environment, financial position, financial analysis with reference to the industrial requirement, SWOT analysis and there after the conclusion.... The following report is intended to analyze the major aspects which has made du company grow in such a high rate, it will be based on the strength of the company and also the financial statement will be analyzed in order to predict the future performance of the business....

14 Pages

(3500 words)

Research Paper

Ratio Analysis of Financial Statements

An effort has been made in this write up to analyze the overall financial performance of Maclnray's in order to ascertain the bank's possible report with regard to sanctioning of the loan.... Its calculations involve the use of profits before interest and taxes in order to match total assets performance only operational results.... This paper "Ratio analysis of Financial Statements" discusses the system of ratio analysis that has been adopted for purposes of such analysis....

9 Pages

(2250 words)

Case Study

Benefits and Limitations of Ratio Analysis

It is always possible to trace the business historical performance, and newly hired employees should be trained on its basics and how to use it so that they may be able to know the kind of data between the company and other competitors in the past.... The paper "Benefits and Limitations of Ratio Analysis" is a great example of a finance and accounting essay.... The paper "Benefits and Limitations of Ratio Analysis" is a great example of a finance and accounting essay....

9 Pages

(2250 words)

Essay

Next Plc - Business Description

The paper "Next Plc - Business Description " is a perfect example of a finance and accounting case study.... The paper "Next Plc - Business Description " is a perfect example of a finance and accounting case study.... In addition to its catalogue sales operation and retail stores service, the company offers financial services under the name of Next brand credit financing....

6 Pages

(1500 words)

Case Study

The Computation and Adjustments of Statement of Financial Position and Income Statement

The paper "The Computation and Adjustments of Statement of Financial Position and Income Statement" is a great example of a finance and accounting report.... The paper "The Computation and Adjustments of Statement of Financial Position and Income Statement" is a great example of a finance and accounting report.... It then presents the analysis of the two financial.... It then presents the analysis of the two financial statements of the organization....

6 Pages

(1500 words)

Financial Statements Analysis

Chapter three entails an overview of the project where the financial statement introduction has been done.... The paper "Financial Statements Analysis" is an amazing example of a finance & Accounting research paper.... The paper "Financial Statements Analysis" is an amazing example of a finance & Accounting research paper.... The paper "Financial Statements Analysis" is an amazing example of a finance & Accounting research paper....

20 Pages

(5000 words)

Research Paper

Woolworth Financial Statement Analysis

The paper 'Woolworth financial statement analysis' is a great variant of a report on finance & accounting.... The paper 'Woolworth financial statement analysis' is a great variant of a report on finance & accounting.... The paper 'Woolworth financial statement analysis' is a great variant of a report on finance & accounting.... Trend analysis involves analyzing a company's financial data over a given period.... analysis of the trend over several years is done by calculation of the trend percentage....

11 Pages

(2750 words)

Financial Statement Analysis - JB HI FI Ltd

The paper "financial statement analysis - JB HI FI Ltd " is a perfect example of a finance and accounting research paper.... The paper "financial statement analysis - JB HI FI Ltd " is a perfect example of a finance and accounting research paper.... The paper "financial statement analysis - JB HI FI Ltd " is a perfect example of a finance and accounting research paper.... In addition, the report focuses on the analysis and interpretation of two years of Harvey Norman's financial statements....

11 Pages

(2750 words)

Research Paper

sponsored ads

Save Your Time for More Important Things

Let us write or edit the case study on your topic

"Financial Statement Analysis and Finance Performance: Agroproquim, C.A"

with a personal 20% discount.

GRAB THE BEST PAPER

✕

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY