I will provide the details shortly Coursework Example | Topics and Well Written Essays - 1000 words. https://studentshare.org/finance-accounting/1811347-i-will-provide-the-details-shortly

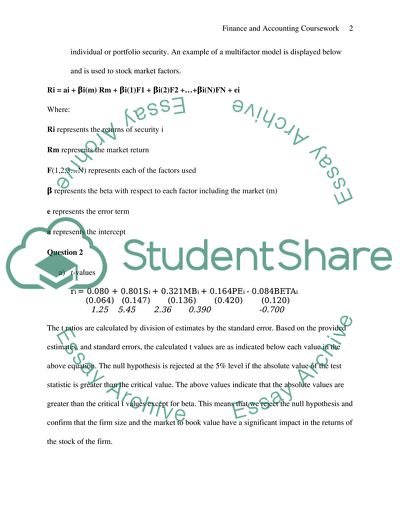

I Will Provide the Details Shortly Coursework Example | Topics and Well Written Essays - 1000 Words. https://studentshare.org/finance-accounting/1811347-i-will-provide-the-details-shortly.